On March 15, 2024, the National Association of Realtors® (NAR) announced a $418 million settlement with a nationwide class of plaintiffs in an antitrust lawsuit. The lawsuit centered around claims that Realtors® conspired to artificially inflate commission rates by not being transparent about how buyer’s agents are compensated.

So, what’s changing about how buyer’s agents are compensated?

Today, when a seller’s agent lists a home on a REALTOR®-owned Multiple Listing Service (MLS), they are able to include an offer of compensation to the buyer’s agent as part of the listing. Moving forward, this compensation cannot be advertised on the MLS.

The practice of putting the buyer’s agent commission percentage on the MLS has led many to believe that number is fixed. And many agents have not done a good job explaining that commissions are negotiable.

If the court approves NAR’s settlement, agents will no longer be able to advertise any buyer’s agent’s compensation when they list a home on a REALTOR®-owned MLS. This will encourage agents to have more in-depth conversations with their clients around compensation, promoting greater transparency across the industry.

Lastly, buyers will now be required to sign buyer’s agency agreements to ensure they fully understand the buyer-broker relationship, obligations between broker and client and how their buyer’s agent is compensated.

All in all, it’s too soon to tell exactly how the proposed rule change will impact the housing market. What we do know is that there are too few homes and too much demand — even with current mortgage rates — for home sellers to worry about competing on price, generally speaking.

Speaking of mortgage rates, the Federal Reserve held rates steady at the March meeting, which was in line with expectations. With the information from Fed Chair Powell, we are now expecting rate reductions after the June or July Fed meetings. The Fed’s dual mandate aims for stable prices (inflation ~2%) and low unemployment. Employment has shown its persistent strength, and inflation is coming down, but the Fed wants more good data before lowering rates because they want to avoid raising rates once they’ve started lowering them.

Overall, the market is starting to heat up, which is what we expect and want to see this time of year. Mortgage rates have been elevated for long enough now that buyers and sellers are less hesitant to enter the market. And rate cuts will come in the second half of the year, allowing for refinancing in the near future. As a result, we are expecting far more transactions than last year and a healthier market.

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage for your area. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

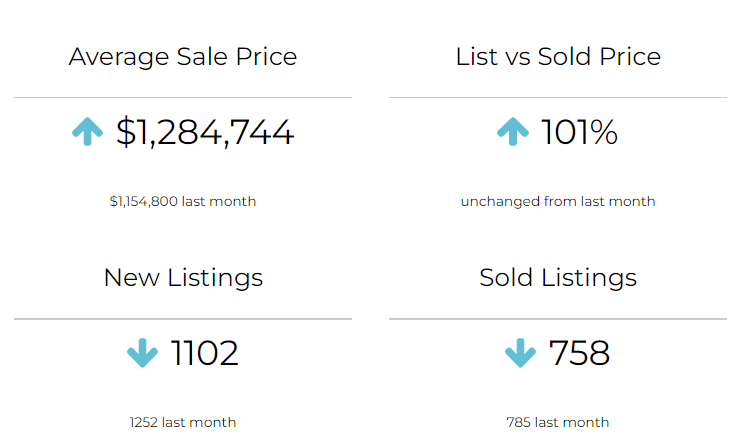

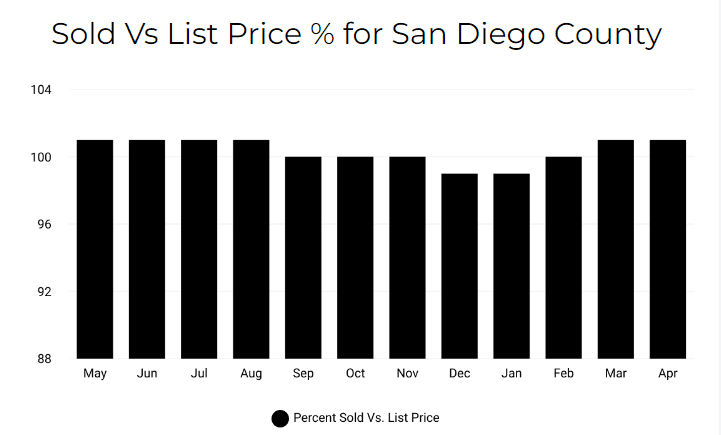

Big Story Data

RSVP FOR OUR GRANNY FLAT SEMINAR

THURSDAY MAY 30, 2024

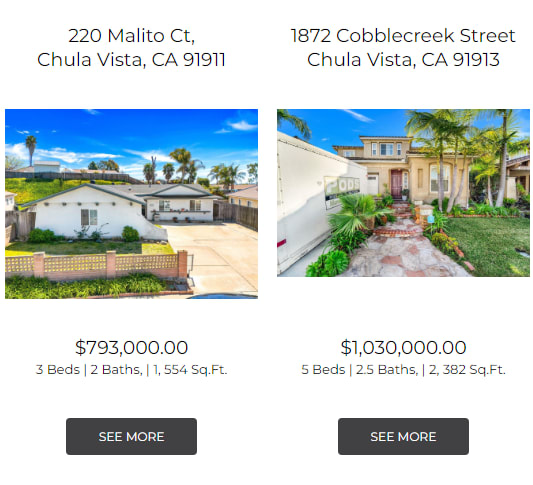

PAST SALES

GOOGLE REVIEWS

Choosing your new pillow

Cushiony comfort will bring sleep relief faster than you can say snooze.

But finding the perfect pillow can be a nightmare, especially when there's so many possibilities to choose from.

Prioritizing price is an emerging trend for buyers

Buyers are beginning to take a different approach to the property market by prioritizing price over location, according to a new survey.

The rising cost of mortgages over the past two years has caused this switch in buyer focus.